Financial Aid Information

Financial Aid

Affordable College Funding: Smart Solutions For Your Budget!

Review the links below to find resources to help with preparing for life after high school, including information on how to search for colleges, tips for writing admissions/scholarship essays, and most importantly - how to pay for the upcoming college expenses!

Financiación Universitaria Asequible: ¡Soluciones Inteligentes para su Presupuesto!

Revisa para encontrar recursos que te ayudarán a prepararte para la vida después de la escuela secundaria, incluyendo información sobre cómo buscar universidades, consejos para escribir ensayos de admisión/becas y, lo más importante, ¡cómo pagar los gastos universitarios!

Financial Aid Graduation Requirement

Each high school senior in a Texas public school district or open enrollment charter school, beginning with the Class of 2022, must complete and submit a Free Application for Federal Student Aid (FAFSA) or a Texas Application for State Financial Aid (TASFA) as a state requirement for graduation.

Texas Education Code §28.0256 allows a student to opt out of the financial aid application graduation requirement by submitting a signed form that authorizes the student to decline.

You can download the YISD Notification Letters (English) for additional information.

---------------------------------------------------

Iniciando con la generación 2022, cada alumno de 12º grado inscrito en un distrito escolar público en Texas o en una escuela subvencionada de inscripción abierta deberán llenar y entregar, como requisito estatal de graduación, una Solicitud Gratuita de Ayuda Federal para Esdudiantes (FAFSA por sus siglas en inglés) o la Solicitud de Ayuda Financiera Estatal de Texas (TASFA por sus siglas en inglés).

El Código de Educación de Texas Texas Education Code §28.0256 permite que el alumno se excluya del requisito de graduación de ayuda financiera presentando un formulario firmado autorizando el rechazo de dicha ayuda.

Financial Aid Workshops

Download the schedule below of Financial Aid Workshops available for parents and students for assistance with the application. You may attend a workshop at ANY of the YISD campuses. Please note the various times available for each campus.

How Do I Apply?

Financial aid applications are available in December of your Senior year.

72% of all college students received some type of financial aid

Some scholarships require FAFSA / TASFA completion, so make sure you apply even if you think you won't qualify

More than $185 billion in aid is available

On average,it takes 24.13 minutes to complete the FAFSA from start to finish

YISD Go Center Specialist and School Counselors can help you!

Dates to keep in mind:

State of Texas priority deadline is February 15th

Do I have to provide my parents' information on my financial aid form?

See this Dependency Guide to help you determine if you will be required to submit your parents' information. NOTE: if you have special household circumstances that may prevent you from obtaining your parents' information, you can still submit your financial aid application. You will just have to work closely with your college financial aid office.

Use this Who's My Parent Guide to determine whose information you will need in situations where your parents are unmarried, divorced, separated, etc.

FAFSA

Free Application for Federal Student Aid - How to Fill Out the FAFSA Form

Financial aid for students who are US citizens or US Permanent Residents

Must first create a username and password called an FSA ID here: Website for the student and one parent - see helpful VIDEO

we recommend you use a personal email account and NOT your YISD email account as you will need to be able to access it in the future after graduation

Use the FSA ID Worksheet below to help save your information

Apply online: Website

How to get started: Website

The Financial Aid questions will ask for information about you (your name, date of birth, address, etc.) and about your financial situation. Depending on your circumstances (for instance, whether you’re a U.S. citizen or what tax form you used), you might need the following information or documents as you fill out the application, download this list of Financial Aid Documents Needed below to help!

TASFA

Texas Application for State Financial Aid

Financial aid for students who are foreign/non-citizens but are classified as a Texas Resident

Apply online at Website

REMEMBER: Keep all of your original records! You may need them again.

Sign Up With Wyatt for Fafsa Support!

Why Apply for Financial Aid?

What is federal financial aid (FAFSA)?

The FAFSA is available to students who are U.S. Citizens or Permanent Residents.

Subscribe to the Federal Student Aid YouTube Channel

Watch their videos on what financial aid is, how to apply, etc.

Federal Student Aid YouTube Channel

What is state financial aid (TASFA)?

The TASFA is available to noncitizens who are Texas residents.

English - Completing the TASFA

En Español - Completing the TASFA

What's Next After Submitting the FAFSA?

Check Your Student Aid Report (SAR)

Once you receive your Student Aid Report (SAR), it is important that you review this information carefully to see what additional steps you might have to take.

Step One:

Submit copy of SAR to your school Counselor or Go Center Specialist for help reviewing the information provided.

Step Two:

If you have a "*" symbol next to your Estimated Family Contribution (EFC) then you have been selected for verification. Verification is a process for the institutions to confirm the information you provided is correct.

Step Three:

If you have a "C" symbol next to your EFC, then there is some information you provided that needs to be corrected. You will need to log back in to your FAFSA account and make the corrections.

Step Four:

If you have an "H" symbol next to any of your answers submitted, this means that there isa question about your answer which may need to be cleared up. Log in to your FAFSA account to make any additional corrections.

See this hand-out below for additional information:

*Source: uAspire

Completing the Financial Aid Process

Once your financial aid application is submitted, please note that there are still some additional steps to follow to ensure the college/university has received your application and that all of your information is accurate.

See this hand-out below that explains this process:

*Source: uAspire

Were You Selected for Verification?

Provide Required Verification

You might see a note on your SAR saying you’ve been selected for verification; or your school might contact you to inform you that you’ve been selected. Verification is the process your school uses to confirm that the data reported on your FAFSA form is accurate. If you’re selected for verification, your school will request additional documentation that supports the information you reported.

Don’t assume you’re being accused of doing anything wrong. Some people are selected for verification at random; and some schools verify all students' FAFSA forms. All you need to do is provide the documentation your school asks for—and be sure to do so by the school’s deadline, or you won’t be able to get financial aid.

If you used the Internal Revenue Service Data Retrieval Tool (IRS DRT) when filling out your FAFSA form, you may not have to verify that information. In the following cases, however, your school may require you to submit an IRS tax transcript or a signed copy of your income tax return as part of the verification process.

You didn’t use the IRS DRT.

You used the IRS DRT and reported rollovers.

You used the IRS DRT but also amended your tax return.

See this website for more information:

How to Review and Correct Your FAFSA Application

Verification Handout (Guide)

See the handout below for additional information on what steps to take next:

*Source: uAspire

What to Do If You're Selected for FAFSA Verification

*Source: nerdwallet

Need An IRS Tax Transcript?

Request Tax Transcript Online

You can request an IRS Tax Transcript at:

Call the IRS Over the Phone

Contact the IRS at: 1-800-908-9946

Submit Written Request Using Form 4506-T

Use the link below to download IRS Form 4506-T to request your tax transcript:

Contact the IRS Office in El Paso for an in-person appointment

Address: 700 E San Antonio Ave, El Paso, TX 79901

Hours: M-F 8AM to 5PM

Phone: (800) 829-1040

Need Help Applying?

Do you have unanswered questions about the Free Application for Federal Student Aid (FAFSA®) process?

Find answers to common questions that FAFSA® filers may have here:

Do you have unanswered questions about the Texas Application for State Financial Aid (TASFA) process?

Contact your college(s) of choice Financial Aid office(s) for more information.

Remember, you must submit a TASFA application to each university you are applying to.

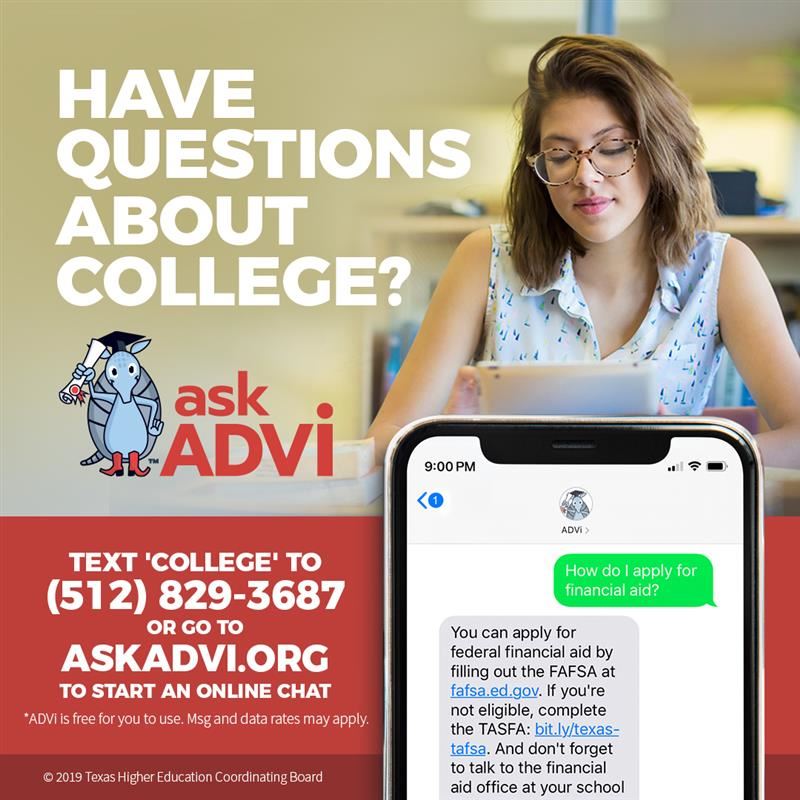

Ask Advi for Help 24/7